Students of poverty in America have searched for its roots in many areas, including racism, culture, genetics, personal responsibility, and social policy. Taxes, by contrast, have received little attention. In Taxing the Poor, Katherine S. Newman and Rourke L. O’Brien respond to this oversight with an illuminating survey of how tax policy in the South has contributed in major ways to the poverty endemic in the region on both sides of the color line.

Compared to the rest of the country, the states of the old Confederacy depend to a great extent on sales taxes as a source of revenue. Similarly, the South imposes much lower corporate and progressive income taxes. The result is that the burden of funding the government falls disproportionately on those least able to pay. One of the major consequences of these policies is that the states of the region are significantly underfunded, especially in providing services for the poor. Another is that high sales taxes — especially on groceries and other necessities — drain a substantial portion of the poor’s meager income, putting them at a great disadvantage even when compared to the poor in other regions.

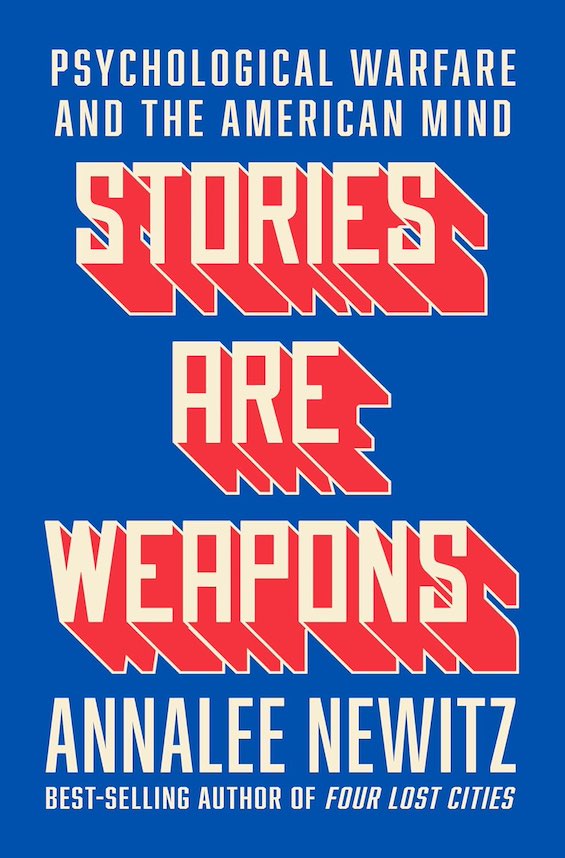

Taxing the Poor: Doing Damage to the Truly Disadvantaged by Katherine S. Newman and Rourke L. O’Brien (2011) 263 pages ★★★★☆

However, as the authors make clear, it’s not simply taxes per se that lie at the heart of this problem. Like California, where Proposition 13 has made it virtually impossible for state or local government to raise new taxes by imposing a supermajority rule on both legislation and popular initiatives, the states of the South have their own supermajority rules. Significantly, though, those rules were adopted decades before 1978, when Proposition 13 was passed.

Newman and O’Brien make clear that the historical origins of this disjunction between the South and the rest of the country lie in the decades leading up to the Civil War, when the slaveholding elite held the reins of government and succeeded in deflecting the cost of running the states by eliminating or minimizing taxes on their “property.” The years of Radical Reconstruction (1865-77) corrected some of this imbalance, but the progressive policies enacted then were reversed in the reactionary time that followed, when the foundations of Jim Crow society were firmly laid. Southern elites — conservative and racist Democrats — even managed to blunt the impact of the New Deal by exempting domestic and agricultural workers from Social Security until the 1950s.

Policies in the West are drifting toward the pattern in the South

The book does not dwell exclusively on the states of the South. The data excavated by the authors reveals that policies in California and its neighboring Western states have been moving in the same direction, most notably with Proposition 13’s supermajority rules defunding the schools and the state’s human services.

Taxing the Poor, published by the University of California Press, is the work of two sociologists, Katherine S. Newman of the University of Massachusetts Amherst (formerly of Johns Hopkins and UC Berkeley) and Rourke L. O’Brien, a Ph.D. candidate at Princeton. The book is based on a lecture in the UC Berkeley Wildavsky Forum. The authors make their case with a generous use of maps, charts, and tables that gives a visual dimension to the statistics underlying their study. Yet, unlike so much work from academics, they manage to make the book readable. There are few excursions into statistical mumbo-jumbo in its pages.

As American history, not just the sociology of poverty, Taxing the Poor is a solid piece of work.

For more reading

This is one of the many Good books about racism reviewed on this site, Good books about economic inequality, and 10 enlightening books about poverty in America.

Like to read books about politics and current affairs? Check out Top 10 nonfiction books about politics.

Also, see Top 20 popular books for understanding American history.

And you can always find my most popular reviews, and the most recent ones, plus a guide to this whole site, on the Home Page.

Way back when I lived in New Orleans in the early 80s, I saw the results of Louisiana’s “Homestead Exemption”, wherein property taxes exempted a large portion of a home’s value. The obvious result was an underfunded public school system. The more affluent (that is, white) used this exemption to pay for the children’s education in the parallel Catholic private school system and the public schools were almost exclusively the home of the less affluent (that is, black).