Fifty-five years ago I became a speculator in New York City. Which means that what did helps explain what’s wrong on Wall Street. I was suffering through graduate school at Columbia University at the time and found it much more enjoyable to watch the ticker tape in a broker’s office rather than hang out in a library on the Columbia campus.

Within a short time I graduated from the tame world of gambling on common stocks to more lucrative convertible bonds, silver bullion, and silver futures. All the latter were more highly leveraged than stocks, which meant that I could advance much less of my own money and gamble with more of other people’s. Within a few years, my net worth rose from $2,000, which I’d earned when I sold the coin collection I’d amassed as a teenager, to the equivalent in 2018 of $1.2 million. All that experience initiated me into the arcane world of high finance. But I didn’t have a clue then about what’s wrong on Wall Street.

(For the record, just in case you have any fantasy about asking me for some of it: all the money I made in the 1960s was gone by 1973, most of it to finance a short-lived nonprofit organization.)

Wall Street, from the 1960s to today

Wall Street today bears little resemblance to the financial world of the 60s. When I began trading stocks in 1963, the trading volume at the New York Stock Exchange on a typical day was around four million shares. Today, in 2018, more than one billion shares change hands on pretty much every day at the NYSE—over 250 times as much activity. Half a century ago, common stock and bonds dominated the financial markets. Of course, there were several different types of bonds, and the more discriminating speculator might make use of futures contracts known as “puts” and “calls.” (Today, calls are more familiar as stock options of the sort now frequently granted to corporate executives.)

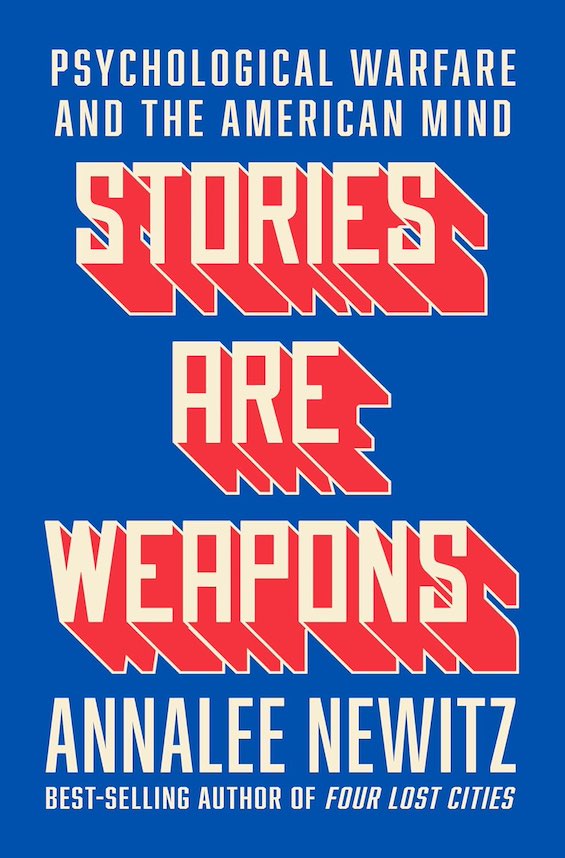

A First-Class Catastrophe: The Road to Black Monday, the Worst Day in Wall Street History by Diana B. Henriques (2017) 394 pages ★★★★★

Financial derivatives come to the fore

Nowadays, there is a bewildering array of financial instruments including index funds, exchange-traded funds, “collateralized debt obligations,” and a large variety of other derivatives that are difficult to understand without a specialized background in finance. Even if you’re unfamiliar with financial history, you may recognize the word derivative, since the widespread use of such devices has been identified (along with subprime lending) as one of the central causes of the Great Recession beginning in 2008. In a major way, these financial instruments are the key to what’s wrong on Wall Street today.

The commodities markets have similarly mushroomed over time. The commodities markets of the 1960s thrived on futures contracts, but trading was typically limited to a few agricultural products (such as hog bellies or soybeans), petroleum, and metals, including copper, silver, and steel. Today the commodities exchanges offer a wider variety of futures contracts in physical products. But, most notably (and irrationally), they feature financial futures, such as currency futures, interest rate futures and stock market index futures. All these instruments are known collectively as derivatives.

These and other changes that began to accumulate in the financial markets in the 1980s would prove to have disastrous consequences in the years ahead, as we know all too well from recent experience. But proof of the danger would come far earlier, in October 1987.

“The worst day in stock market history”

Immediately below is a chart of the Dow Jones Industrial Average, year by year, from 1928 to 2018. If you look very, very closely, you may find somewhere along the gently upward-sloping curve of the 1980s what looks like a modest decline in the average. See it? You’ll have to squint. Even then, maybe not. It looks like a tiny inverted “V” about two-thirds of the way from left to right. I’ve chosen a small version of the chart to emphasize just how small that drop in the market seems over the long haul.

However, that seemingly modest decline encompassed what Diana B. Henriques calls “the worst day in Wall Street history” in her history of the period, A First-Class Catastrophe. On Black Monday, October 19, 1987, the Dow collapsed, falling a record 508 points. By 21st-century standards, that number is indeed modest. From 1998 to 2018, at least twenty days have seen larger point declines. However, in October 1987, 508 points represented the largest percentage decline in the history of the average. On that single day, the most widely-watched financial indicator in the world dropped a staggering 22.6%. And the loss for the week was even greater: “the worst one-week decline in Wall Street history.”

Panic spread around the world, with other closely-followed stock market indices down even more sharply in the UK, Hong Kong, Australia, Spain, and New Zealand. It was, indeed, a first-class catastrophe. For months afterward, as government officials and financial executives everywhere scrambled to make sense of what went wrong, fear was widespread that a deep recession might not be far behind. In fact, two years went by before the Dow recovered its pre-Black Monday level.

The most lucid financial history in many years

Thirty years after the event, it’s easy to question why anyone would write a nearly 400-page book about that day, “the worst day ever” notwithstanding. However, Henriques explains in vivid terms just how important it is to understand what went awry in October 1987, since the problems that caused Black Monday are essentially the same as those at the root of the Great Recession triggered by the stock market crash of 2008. In some ways, those problems have gotten worse—and for the most part they have not been corrected by any legislation, any self-regulation in the financial industry, or any White House action since 2008. (Some modest reforms were incorporated into the legislation known as Dodd-Frank, but even those are now under fire and may well be eliminated by the current US Congress.)

A First-Class Catastrophe should be essential reading for anyone who is serious about investing in the financial markets. It’s the most lucid and easily understood example of financial history that I’ve read in many years. It is, simply, masterful. Another author might have told the story in terms of numbers and jargon. Henriques’ account focuses on people. The book begins with a lengthy cast of characters that seems daunting at first but proves to be simply useful. The principal characters on that list emerge as living, breathing human beings on the pages of this superb book: regulators like Paul Volcker and Alan Greenspan at the Federal Reserve, top financial industry executives, the president of the New York Stock Exchange, the chief investment officers at giant pension funds, and two professors in the business school at the University of California, Berkeley.

The root causes of the stock market crash of 1987

The proliferation of derivatives was unquestionably a root cause of Black Monday. Many of these new financial devices were either entirely unregulated or encouraged by regulators who were captive to the industries they oversaw. (Remember that Ronald Reagan was in the White House in 1987 and had been for six years at that point, affording him ample time to reshape the government’s response to the financial markets to suit his antipathy to regulation.) In 1987, the principal culprits were computer-assisted trading, “academic theories that led giant herds of investors to pursue the same strategies at the same time with vast amounts of money,” and futures contracts pegged to the Dow and the Standard & Poor’s 500. These and other “financial futures had fundamentally changed the way the traditional stock market worked” in less than five years.

What Black Monday also brought to light was “a regulatory community that was poorly equipped, ridiculously fragmented, technologically naïve, and fatally focused on protecting turf rather than safeguarding the overall market’s internal machinery,” Henriques explains. Quite simply, there were (and are) far too many official regulators that oversee the financial industry: the Federal Reserve Bank, Federal Deposit Insurance Commission, Office of the Comptroller of the Currency, Office of Thrift Supervision, Securities and Exchange Commission, Commodity Futures Trading Commission, Financial Industry Regulatory Authority, state bank regulators, and state insurance regulators. Small wonder that they didn’t (and don’t) act in concert, even during the most spectacular crises. A disaster on the order of the Great Recession was averted in October 1987 only through “a makeshift web of trust, pluck, and improvisation—and perhaps a few bits of inspired subterfuge here and there.”

A single marketplace, and the government is clueless

A government task force assembled by the Reagan Administration concluded “that technology and financial innovation had welded once-separate markets [primarily the stock and commodities markets] into a single marketplace, but government, the financial industry, and academia had failed to see what had happened and adapt to it.” Henriques notes in her epilogue that “Unfortunately, we cannot simply turn the page on the crash of 1987, because we are still living in the world revealed to us on Black Monday.” If anything, conditions have deteriorated since then. The crash of 2008 and the ensuing Great Recession make that point all too emphatically.

Diana B. Henriques has reported and written for the New York Times since 1989, where she won a Pulitzer Prize for her reporting on the aftermath of 9/11. A First-Class Catastrophe is her fourth book. A popular, earlier effort, The Wizard of Lies: Bernie Madoff and The Death of Trust, was published in 2011.

For related reading

Other reviews on this site that might interest you include Greed, jealousy, and betrayal at the heart of Wall Street’s collapse, Who’s to blame for the financial crisis? and Hedge funds, insider trading, and the most wanted man on Wall Street.

This is one of 7 insightful books that explain what caused the Great Recession.

Like to read books about business? Check out My 10 favorite books about business history.

And you can always find my most popular reviews, and the most recent ones, on the Home Page.