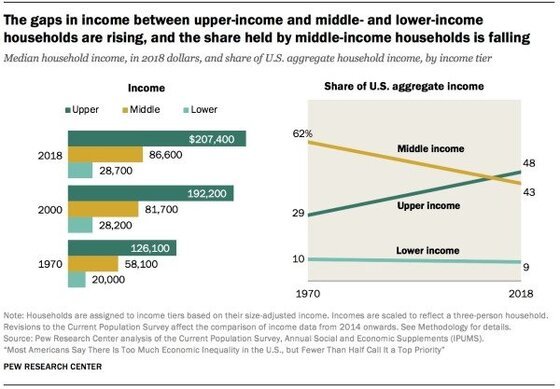

Today, many Americans puzzle over why the Great Recession happened. Amazon lists more than 1,000 books on the subject. But readers today might benefit from taking a longer view. Because, as Frederick Lewis Allen told the tale in The Lords of Creation nearly ninety years ago, the conditions that arose in the Gilded Age and the Roaring Twenties and lay at the root of the Depression bear an uncanny resemblance to those of the current era beginning late in the 1970s.

Estimated reading time: 12 minutes

To understand why the Great Recession happened, start here

When Allen’s book appeared in 1935, the United States (and the world) was in the throes of the Great Depression. The previous year the nation’s economy had begun its long, slow climb out of the depths reached in 1933. Franklin Roosevelt’s New Deal was beginning to pay off. But policymakers and the public alike yearned to understand how things had gotten so bad. And economists were almost without exception among those who celebrated the 1920s boom up until the day it went bust. So, historians like Harper’s Magazine editor Frederick Lewis Allen took up the challenge to explain what lay behind the greatest economic catastrophe in American history. He found the roots of the crisis in the emergence of the trusts, the holding companies, and stock watering late in the nineteenth century. The Lords of Creation makes the case in lively, readable prose.

The Lords of Creation: The History of America’s 1 Percent by Frederick Lewis Allen (1935) 442 pages ★★★★☆

Common themes in America’s economic history

“Run out and buy Europe for me.”

During the decades following the Civil War (1961-65), American business grew big. What began as small, family-owned enterprises gobbled up competitors right and left and grew into massive corporations called “trusts“—first Standard Oil, then many others in railroads, banking, utilities, and other industries. Allen notes that “by 1900 the census showed that there were no less than 185 industrial combinations in existence.” Their success boosted the economy and set off wild speculation in the securities markets. “The center of gravity of American industrial control was moving, and the direction of its movement was immensely significant. It was moving toward Wall Street.” Allen adds: “That aptest commentator of the day, Finley Peter Dunne’s ‘Mr. Dooley,’ described Morgan as now being able to say to one of his office boys, ‘Take some change out iv th’ damper an’ r-run out an’ buy Europe for me.'”

The Progressives and the muckrakers

Beginning shortly before the turn of the twentieth century, “muckrakers” such as Ida M. Tarbell and Lincoln Steffens exposed the abuses through investigative journalism. Self-identified Progressives moved to curb Wall Street’s many abuses through laws limiting the financiers’ freedom of action. And the federal government under Theodore Roosevelt, William Howard Taft, and Woodrow Wilson began to enforce antitrust law that, one by one, broke up some of the very biggest of the ventures. (Roosevelt thundered about “malefactors of great wealth,” although his efforts to do anything about them seemed half-hearted.) But the Progressive movement was spent by the 1920s. The titans of Wall Street and Big Business simply invented clever new devices to work around the laws, such as they were. And successive Republican administrations during the Roaring Twenties declined to rein in the wild speculation that led to the stock market Crash of 1929. The US government in the years leading up to 2007 was equally ineffectual, so it should be no surprise why the Great Recession happened.

Contrasting Big Business in 1929 with today’s

“In 1929,” Allen reports, “there were over three hundred thousand non-financial corporations in the country.” Today, there are 32.5 million. Then, “the biggest two hundred of these giants controlled nearly half of all the corporate wealth and did over two-fifths of the business in the non-financial field.” Now, according to Fortune magazine, “Fortune 500 companies represent two-thirds of the U.S. GDP with $13.7 trillion in revenues, $1.1 trillion in profits, $22.6 trillion in market value, and employ 28.7 million people worldwide.” In other words, despite everything done over the course of the twentieth century to regulate business, the private sector was more concentrated and the biggest companies more powerful than they’d been in 1929 after a decade of runaway speculation. Is it really hard to understand why the Great Recession happened?

Forerunners of the tech giants

Does any of that sound alien today in the age of Google, Apple, Facebook, and Microsoft? In a world where the managers of the top hedge funds take home pay of a billion dollars or more every year? Does the “pro-business” orientation of the Reagan, Clinton, Bush, and Trump administrations sound notably different from those of the men at the helm of the nation in the 1920s? And do the reforms introduced in the 1960s and under Barack Obama seem to have made enough of a difference to prevent another major economic reversal? Economists say they haven’t.

The men who defined capitalism as we know it today

Much of Allen’s argument rests on his study of the men he identifies as central to the story. Their stories are revealing as we seek to understand why the Great Recession happened. In chronicling events during the first phase of the tale, from roughly 1890 to 1920, he cites ten individuals. Fifty make the list for the period 1920 to 1935. Most of the names on the larger list have vanished into the mists of history, no doubt because with few exceptions they were all losers in the Wall Street casino of the 1920s. Not so with those Allen points to in the earlier period, whom I’ve grouped into three categories. Consider how many of these ten names are still familiar today. And take note that, with one exception, they all died at least ninety-nine years ago. Yet they all have Wikipedia entries in 2021.

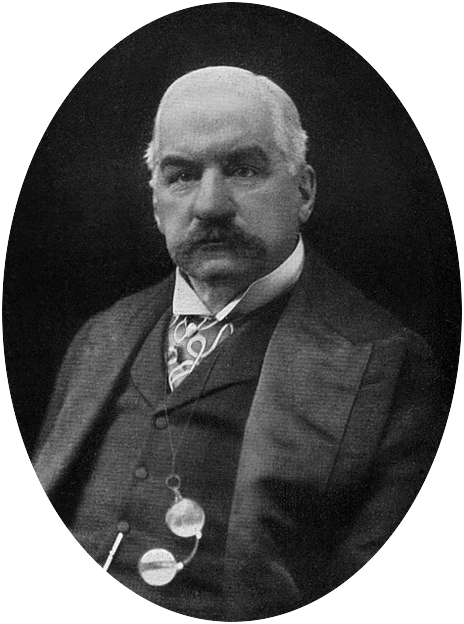

The bankers

J. Pierpont Morgan (1837-1913), the grand old man of Wall Street. Allen calls him “Old Jupiter.” Architect of United States Steel, International Harvester, General Electric, and other market-dominating corporations. As Wikipedia notes, he “dominated corporate finance on Wall Street throughout the Gilded Age.” He was widely quoted to insist to an inquisitive reporter who asked him whether he owed the public an explanation about the stock market panic he had helped cause that “‘I owe the public nothing.'” His bank morphed into today’s JPMorgan Chase & Co. through many, many mergers over the years. Today, it’s by far the biggest bank in the US.

George F. Baker (1840-1931), Morgan’s right-hand-man. President of the First National Bank whom Allen describes as “solid, tenacious, and silent.” According to Wikipedia, “at his death he was estimated to be the third richest man in the United States, after Henry Ford and John D. Rockefeller.” As TIME magazine said of him in its 1924 cover story, “True, he is twice as rich as the original J. P. Morgan, having a fortune estimated at 200 millions. True, at the age of 84 when he has retired from many directorates, he dominates half a dozen railroads, several banks, scores of industrial concerns.”

James Stillman (1850-1915), “the brilliant and cold-blooded president of the National City Bank,” forerunner of today’s Citibank. Under his leadership, the bank may have become the biggest in the Western Hemisphere and was certainly the biggest in the US. As an investigation by the House of Representatives revealed, “the indirect influence of Morgan, Baker, Stillman, and their aides was prodigious.”

Jacob H. Schiff (1847-1920), German-born Jewish American banker, businessman, and philanthropist. In Allen’s words, “the shrewd and kindly head of the banking house of Kuhn, Loeb & Co.” Foremost Jewish leader in the United States for the last four decades of his life. At first, a rival to J. P. Morgan, later a close collaborator.

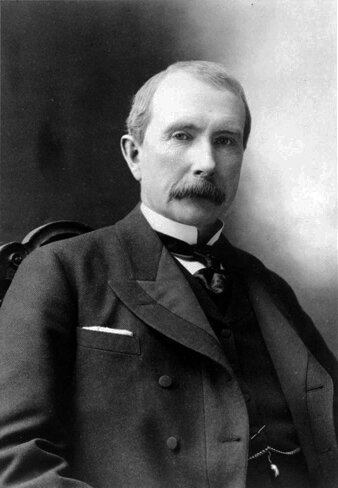

The industrialists

John D. Rockefeller (1839-1937), founder of Standard Oil, which trustbusters spun off into companies that today have the names ExxonMobil, Marathon Petroleum, Amoco, and Chevron, among others. The world’s richest man in his day. Some scholars estimate he would be worth $400 billion today, although I’ve seen other estimates putting the total at around $175 billion, which is slightly less than the net worth reported for Jeff Bezos of Amazon and Elon Musk of Tesla and SpaceX.

Edward H. Harriman (1848-1909), who built a nationwide railroad empire on the backs of the Union Pacific Railroad through mergers and stock market operations. J. P. Morgan called him “that little fellow Harriman.” The old man’s contempt notwithstanding, Allen points out, “Harriman may thus be regarded as two men in one—a sharp financier on the make, and an extraordinary railroad builder.” He was the father of Averell Harriman, one of the “Wise Men” who dominated US foreign policy in the 1950s and 60s.

The investors and speculators

William K. Vanderbilt (1849-1920), a grandson of Commodore Cornelius Vanderbilt. He was “the indolent chief representative of a family still powerful in the railroad and investment world.” Vanderbilt managed his family’s railroad investments and was active in horse-racing. His daughter Consuelo marrried Charles Spencer-Churchill, 9th Duke of Marlborough, a close friend of his first cousin Winston Churchill.

William Rockefeller (1841-1922), John D.’s younger brother, a cofounder of Standard Oil who turned to speculating in securities. Wikipedia: “He helped to build up the National City Bank of New York, which became Citigroup. He was also part owner of Anaconda Copper Company, which was the fourth-largest company in the world in the late 1920s.”

Henry Huttleston Rogers (1840-1909), a leader at Standard Oil and active in the gas industry, copper, and railroads. According to his biographer: “pitiless in business deals, in his personal affairs he was warm and generous.” Wikipedia: “After 1890, he became a prominent philanthropist, as well as a friend and supporter of Mark Twain and Booker T. Washington.” But in business he was contemptuous of any effort to look into his affairs. In one court case, he “refused to admit knowing where the offices of the Standard Oil Company of Indiana were” and added “‘It is quite immaterial to me what the Supreme Court of Missouri desires me to say to them, other than what I have testified.'”

James R. Keene (1838-1913), “a stock exchange operator of commanding skill and prestige.” He was a Wall Street stockbroker and, like William Vanderbilt, a major thoroughbred race horse owner and breeder.

Still famous, a century later

You’ll note that every one of these ten men was born between 1837 and 1850. And with the single exception of John D. Rockefeller Sr. (who was retired by then) they had all passed from the scene by the beginning of the 1920s. Yet even after the passage of nearly two centuries what these men did in their lifetimes set the scene for the Great Depression. And their impact has continued to the present day, when the American economy still reflects attitudes they held and legislation they influenced so very long ago. Yes, during the Progressive Era, the New Deal, and again in the 1960s and beyond, the Federal government moved to regulate the conduct of Wall Street and Big Business. But in almost every meaningful respect, the system the Robber Barons began to build in the late nineteenth century endures to this day. It’s called capitalism, and we in the United States experience a particularly freewheeling variety of the system.

About the author

For more than three decades, Frederick Lewis Allen (1890-1954) edited Harper’s Magazine. Under his aegis, Harper’s held sway as one of America’s preeminent intellectual journals. He was the author of six books of history and biography, of which The Lords of Creation was the second to be published. Allen held a Master’s degree from Harvard, where he taught for a time before his first job as an editor at age twenty-four at the Atlantic Monthly.

For related reading

Check out The First Tycoon: The Epic Life of Cornelius Vanderbilt by T. J. Stiles (The first robber baron and the emergence of the corporation). The book won both the National Book Award and the Pulitzer Prize for Nonfiction and is thoroughly enjoyable. If you seek to understand why the Great Recession happened, it’s important to grasp the economic values and policies that originated in the nineteenth century.

This is one of the Good books about billionaires.

See also:

- Winners Take All: The Elite Charade of Changing the World by Anand Giriharadas (Are tech billionaires and hedge-fund managers changing the world for the better?)

- Dark Money: The Hidden History of the Billionaires Behind the Rise of the Radical Right by Jane Mayer (How the Koch brothers are revolutionizing American politics)

- Evil Geniuses: The Unmaking of America by Kurt Andersen (How America lost its way and ended up at war with itself)

- Jackpot: How the Super-Rich Really Live—and How their Wealth Harms Us All by Michael Mechanic—The curious lives of the rich and not-so-famous

You might also enjoy:

- My 10 favorite books about business history

- Top 20 popular books for understanding American history

- 20 top nonfiction books about history

And you can always find my most popular reviews, and the most recent ones, on the Home Page.